The Financing Process

Demystifying Home Loans

The home loan process can feel overwhelming. By collaborating with a trusted lender and remaining informed through every step of the process, from pre-approval to closing, you can have a significantly more comfortable experience. You’ll want to consult with a mortgage specialist (or two) to find a professional who you are confident will provide you with the best care.

To get an idea of what to expect, review the following home loan process steps.

Step One:

Get Pre-Approval

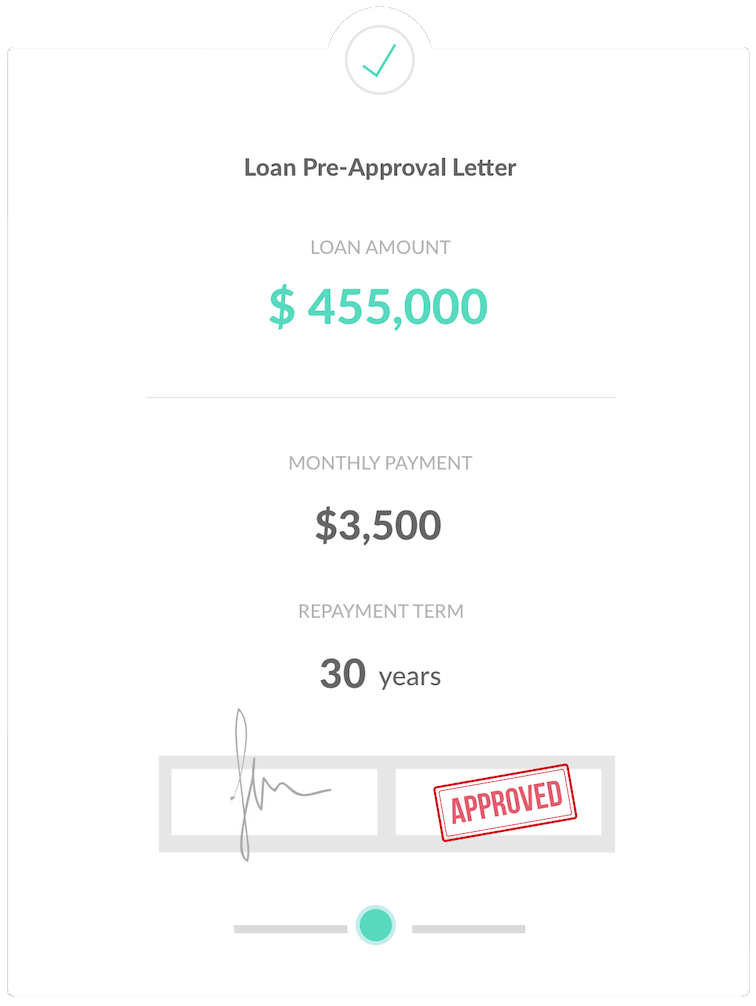

Before you start looking for a home to buy, it’s wise and proactive to meet with a lender to get pre-approved for a loan amount. Offers accompanied by a pre-approval letter are stronger and will stand out, especially when the seller is receiving multiple offers.

To gain pre-approval, your preferred lender will gather information about income, assets, and debts to help determine how much you can borrow. This includes gathering a credit report, W-2 forms, pay stubs, federal tax returns, and recent bank statements.

There are a variety of home loan programs offering different advantages depending on your unique needs and preferences. Your preferred lender can go over the specifics of each to ensure you find a loan option that best aligns with your needs.

Team Nikki Rogers Powered By Lower Mortgage

Nikki Rogers

Loan Officer

NMLS# 519302

With 23 years of experience in mortgage lending, Nikki Rogers is a trusted name in the New Bern, NC community. Raised by a longtime mortgage underwriter, Nikki grew up immersed in the industry and brings a lifetime of insight to every loan she touches. A finance graduate from Virginia Commonwealth University, she specializes in working with first-time homebuyers, relocation clients, and VA buyers—guiding them through the process with clarity and confidence. Now a Senior Loan Officer at Movement Mortgage, Nikki leads Team Nikki Rogers with a commitment to education, transparency, and results.

When she’s not helping families buy homes, Nikki enjoys spending time with her family, exploring new places through travel, and connecting with people in meaningful ways. She brings heart, hustle, and humor to everything she does—both in business and in life.

At her core, Nikki believes that home is more than a place—it’s a foundation for dreams, stability, and legacy. Her goal is to empower clients with the knowledge and support they need to make confident financial decisions. Driven by a passion for service and a deep respect for those she serves, Nikki is committed to building lasting relationships, giving back to her community, and continually growing both personally and professionally.

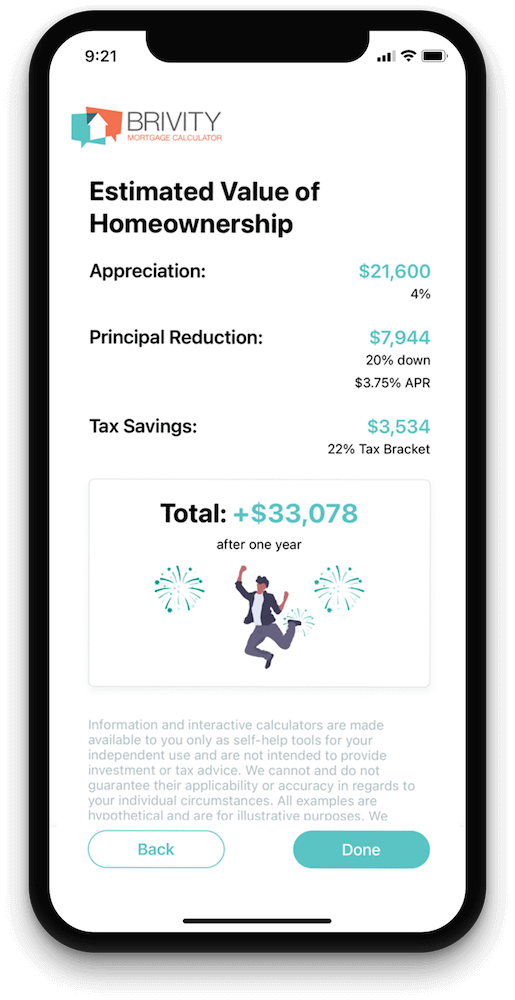

Let's Get StartedEstimate Your Monthly Payment

Estimate your mortgage payment, including the principal and interest, taxes, insurance, HOA, and Private Mortgage Insurance.

Price

Annual Tax

Loan Term (Years)

Down Payment %

Interest Rate %

Monthly HOA

Monthly Insurance

$3,198.20

Estimated Monthly Payment

Principal

$2,398.20

(75.0%)Taxes

$500.00

(15.6%)Private Mortgage Insurance (PMI)

$0.00

(0.0%)HOA

$100.00

(3.1%)Insurance

$200.00

(6.3%)

Step Two:

Find the best loan

Collaborating with a top-notch local loan officer will ensure you have access to competitive rates and programs that best fit your individual needs. Take the first step by completing this form to get connected today!

Step Three:

Application and processing

When you find the perfect property and your offer is accepted, your lender will help you complete a full mortgage loan application, discuss down payment options, and explain any related fees.

Then, your application is submitted for processing where the documents are reviewed. Your lender will also order a home appraisal and a property title search.

The next part of the application process involves sending everything to an underwriter who will review and approve the entire loan package to make sure it meets all compliance regulations.

It is not unusual to receive requests for additional documentation or clarification during this phase of the application process.

Step Four:

Signing and finalizing the deal

Once your loan is approved, you’ll need to set up homeowners insurance.

Your documents will be sent to the title company and the closing will be scheduled for you to sign the necessary paperwork and pay any additional costs to complete the purchase of your new home.

After the loan goes through the required recording process, the purchase is complete, and you officially own your new home!